USA – The global healthcare simulation market is growing fast and is expected to double in size over the next decade.

Currently valued at about US$ 2.5 billion in 2024, it’s predicted to reach nearly US$ 5 billion by 2034, thanks to a strong annual growth rate of 7.5%.

This growth is driven by a combination of factors, including increased investment in medical training, a growing emphasis on patient safety, and the expanding use of simulation tools in healthcare education.

Simulation training is becoming more popular in healthcare because it offers a safe way for students and professionals to practice real-life medical procedures without putting patients at risk.

As healthcare moves toward more hands-on and skills-based learning, simulation tools help users build their confidence and clinical abilities before working in real-world settings.

Driving factors

Several key factors are pushing the market forward. There’s a growing need for healthcare workers to be highly skilled and for hospitals to reduce medical errors.

Simulation training provides realistic practice in controlled settings, enabling medical teams to improve their decision-making and response times.

Technology is also making simulations better. With tools such as virtual reality (VR), artificial intelligence (AI), and data analytics, training has become more interactive and tailored to each learner’s needs.

Governments and regulatory bodies are also supporting this shift. Many now require simulation-based learning as part of healthcare education, ensuring that new healthcare workers meet strict safety and performance standards.

Still, the market faces challenges. High costs are a significant concern, particularly for advanced simulators that require specialized equipment, regular updates, and trained instructors.

There’s also a global shortage of experienced simulation trainers, which makes it harder for some schools and hospitals to offer high-quality programs. In some cases, tight budgets and reliance on traditional teaching methods also slow adoption.

Emerging opportunities

Looking ahead, there are many growth opportunities, especially in developing countries. As these regions improve their healthcare systems, many are starting to invest in simulation to improve training quality.

Partnerships between hospitals, universities, and tech companies are also leading to new tools tailored for local healthcare needs.

For example, adding telehealth practice to simulation training is helping prepare healthcare workers for remote care, something that has become more important since the pandemic.

Learners are also looking for more personalized and flexible training. This is encouraging companies to design modular simulation tools that work for different learning styles and healthcare settings.

Segmentation analysis

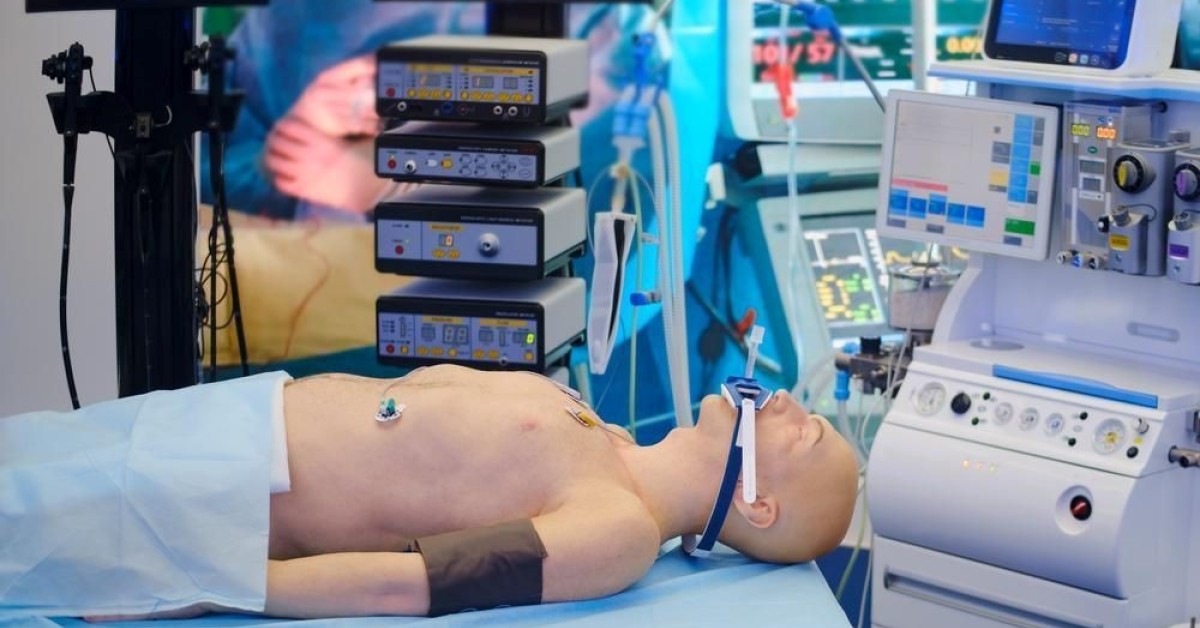

In terms of products, manikins are still the most widely used, especially for practicing emergency care and surgery.

But software-based simulations are growing quickly. These systems often include virtual reality (VR) and AI features and are great for remote learning. Other tools, like training monitors and task kits, are also widely used to support hands-on learning.

Simulations can vary in complexity. High-fidelity simulators closely mimic real medical scenarios and are used in advanced training.

Low-fidelity ones are simpler and more affordable, mainly used for basic skills. Hybrid models combine both for a balanced learning experience.

Most simulation tools are used in medical education, particularly in universities and teaching hospitals. Surgical training is another major area, especially with the rise of robot-assisted procedures.

Simulations are also important for training healthcare workers on patient safety and emergency response.

End users

Hospitals are the biggest users of simulation tools, followed by medical schools and the military. Hospitals use them to keep their staff sharp and meet safety standards.

Schools rely on them to prepare students for clinical work. The military uses simulations for training medics in battlefield care.

Regionally, North America leads the market, making up nearly half of global revenue. The region has strong infrastructure, funding, and big simulation companies like CAE Healthcare and Laerdal Medical.

Europe is also a major player, with countries like Germany, France, and the UK driving growth. Meanwhile, the Asia-Pacific region is the fastest-growing, with countries such as China and India investing more in medical education.

Latin America and the Middle East are still catching up, but awareness is growing, and international support is helping.

XRP HEALTHCARE L.L.C | License Number: 2312867.01 | Dubai | © Copyright 2025 | All Rights Reserved