USA – Biogen has joined forces with Royalty Pharma in a strategic partnership aimed at reducing the financial risks involved in developing its new lupus treatment.

As part of the deal, Biogen will receive US $250 million in funding from Royalty Pharma in exchange for giving up a share of its future revenues from the drug.

Financial agreement and development plans

Announced on Wednesday, this agreement will see Royalty Pharma provide payments to Biogen over six quarters to support the development of litifilimab, an anti-BDCA2 monoclonal antibody currently in Phase III trials.

This experimental drug is being tested for two forms of lupus: systemic lupus erythematosus (SLE) and cutaneous lupus erythematosus (CLE), with final results expected between 2026 and 2027.

In return for its investment, Royalty Pharma will receive milestone payments upon regulatory approvals and mid-single digit royalties from global sales once the drug reaches the market.

Biogen’s Lupus drug pipeline

Alongside litifilimab, Biogen is also developing another late-stage lupus drug, dapirolizumab pegol, an anti-CD40L monoclonal antibody aimed at treating SLE.

While both drugs target lupus, they have different mechanisms of action, which may influence their use in different patient cases.

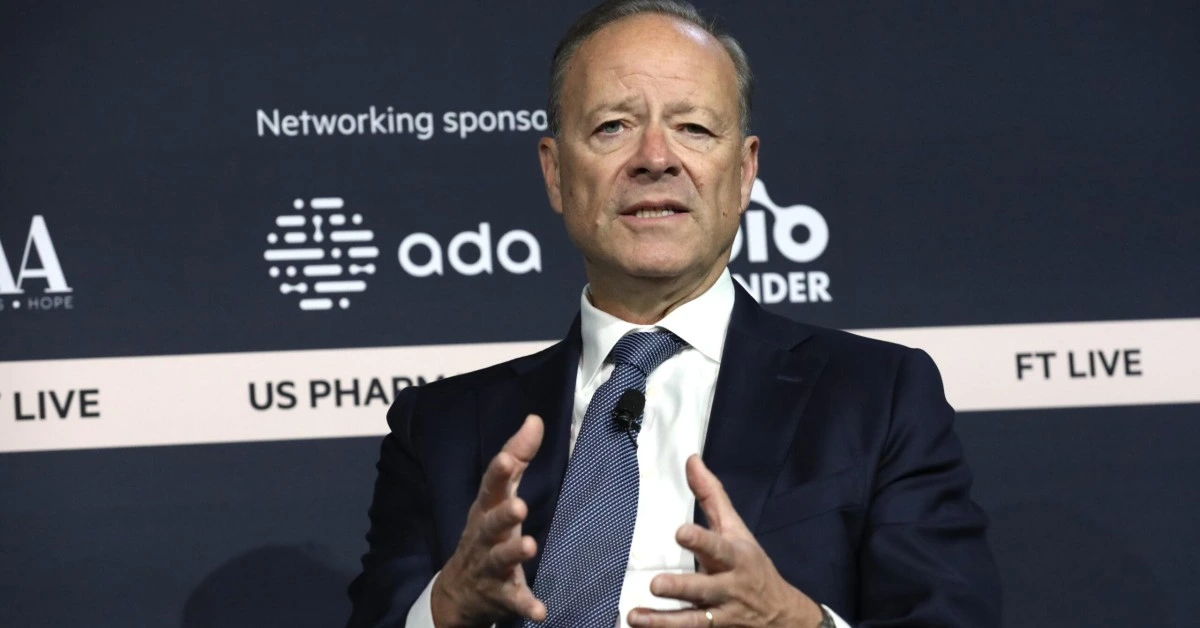

At last month’s JP Morgan Healthcare Conference, Biogen’s CEO, Chris Viehbacher, compared lupus treatment strategies to those used in multiple sclerosis, where different drugs are chosen based on a patient’s specific needs.

He highlighted that litifilimab is unique because of its development for CLE, an area where no drug has been approved yet.

“Litifilimab certainly can play there, where [dapirolizumab pegol] is probably not going to,” he explained.

The ongoing Phase III studies will help determine how these two treatments fit into the broader lupus treatment landscape.

The growing trend of risk-sharing in pharma

This collaboration reflects a growing trend in the pharmaceutical industry, where companies partner with specialized investment firms to manage the high costs and uncertainties of drug development.

These partnerships allow pharmaceutical companies to reduce financial exposure while still benefiting from future success.

For Royalty Pharma, known for acquiring pharmaceutical royalties and investing in biopharmaceutical innovations, this deal provides an opportunity to earn a share of future royalties from Biogen’s lupus treatment.

At the same time, Biogen gains immediate funding, which enables it to continue investing in innovative treatments while mitigating financial risks.

A strategic move for Biogen

By working with Royalty Pharma, Biogen aims to balance financial risk with potential rewards, ensuring continued investment in lupus research and other challenging diseases.

This approach aligns with Biogen’s broader strategy of focusing resources on its core therapeutic areas while maintaining financial flexibility.

XRP HEALTHCARE L.L.C | License Number: 2312867.01 | Dubai | © Copyright 2025 | All Rights Reserved