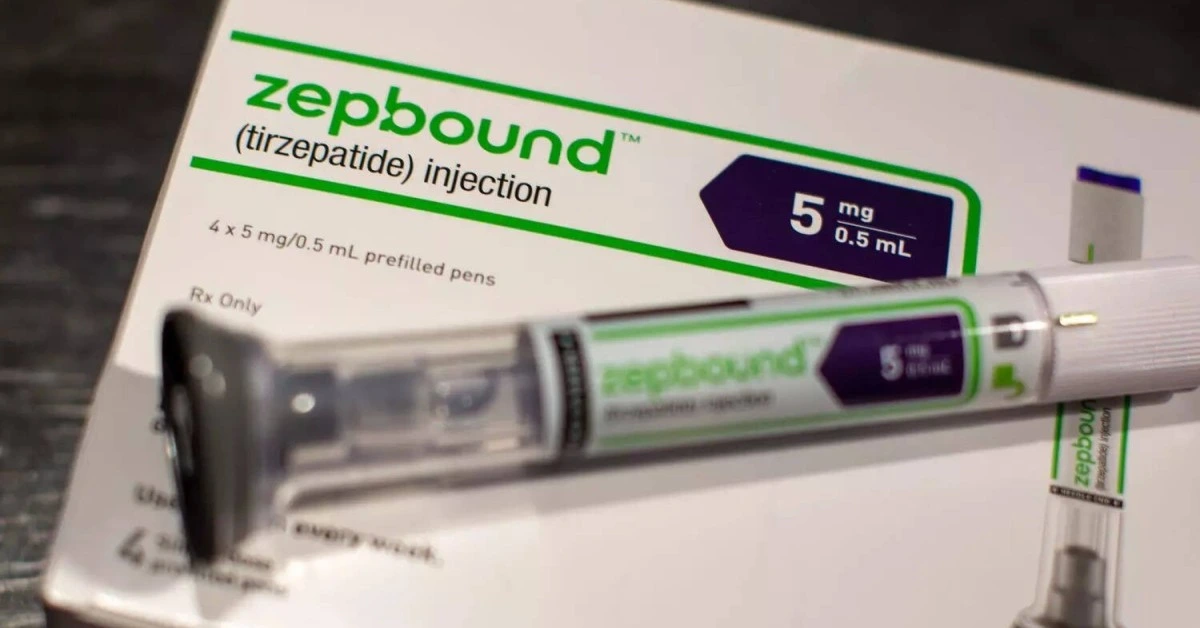

USA – Eli Lilly’s stock took a hit after CVS Health, one of the largest U.S. pharmacy benefit managers (PBMs), announced it would no longer cover the company’s obesity treatment Zepbound (tirzepatide).

The decision sent Lilly’s shares tumbling nearly 12%, despite the company posting a 45% jump in first-quarter revenues, largely driven by strong performance from Zepbound and its diabetes counterpart, Mounjaro.

While Zepbound sales soared to US $2.31 billion—quadrupling year-over-year—Mounjaro more than doubled to US $3.84 billion in Q1 2025.

However, investor enthusiasm waned after Lilly revealed it would not revise its full-year revenue guidance and even slightly trimmed its profit forecast.

Compounding the setback, CVS has chosen to retain coverage of rival drug Wegovy (semaglutide) by Novo Nordisk, following a negotiated price cut and a push to expand self-pay access via partnerships with three leading telehealth firms.

Although Zepbound has recently outpaced Wegovy in prescription volumes—with nearly 339,000 scripts written in the week ending April 18, compared to 212,000 for Wegovy—CVS’s pivot to favor Novo Nordisk casts a shadow over Lilly’s momentum.

CEO David Ricks responded on a conference call, stating he was “not surprised” by the move given Zepbound’s rapid market share gains.

He also criticized one-on-one rebate deals that limit access and choice, affirming that Lilly is focused on broader market growth rather than exclusive pricing battles.

Ricks downplayed the PBM impact, noting that the coverage change primarily affects smaller employers unlikely to reimburse obesity treatments anyway. “We’ll work through it,” he said. “Our job will be to continue to drive share and preference for our brand.”

Despite investor jitters, Lilly’s stock clawed back a modest recovery in after-hours trading. Looking ahead, Ricks pointed to the company’s oral GLP-1 candidate, orforglipron—a once-daily pill with the potential for global scalability.

Data from three of its seven Phase 3 trials are expected this year, with regulatory filings anticipated before year-end.

XRP HEALTHCARE L.L.C | License Number: 2312867.01 | Dubai | © Copyright 2025 | All Rights Reserved